Notice Notice of Tax Arrears

Job Description

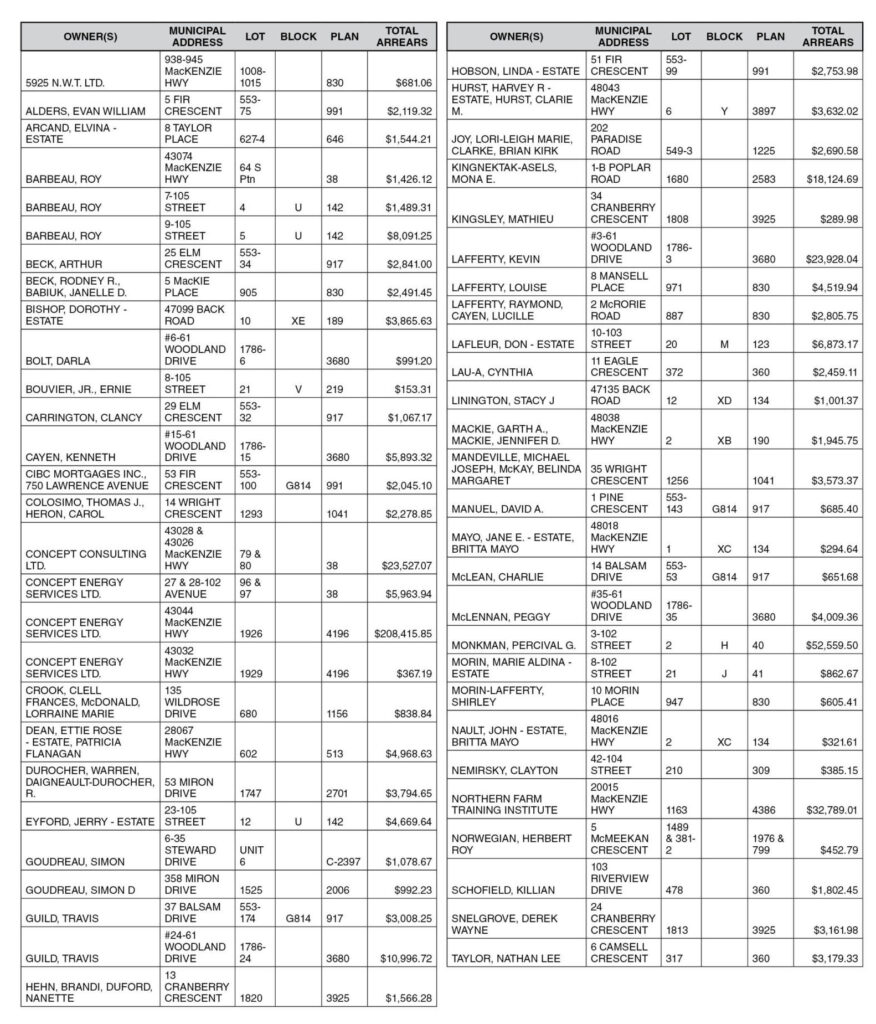

NOTICE OF TAX ARREARS

Pursuant to Section 97.4(1) of the Property Assessment and Taxation Act, R.S.N.W.T. 1988, c. P-10 and amendments thereto, the Municipal Corporation of the

Town of Hay River advises that the following properties are in arrears. These properties may be offered for public auction if the arrears of the property taxes and the current and subsequent expenses incurred by the Town to collect on the arrears are not paid on or before December 31, 2024:

Please be advised of the following:

If prior to commencement of public auction, any person, including the assessed owner, pays the arrears of property taxes and all reasonable expenses incurred by the Town of Hay River to collect the arrears with respect to a taxable property, the property will not be offered for auction. A person who pays the arrears of property taxes and expenses referred to in the above paragraph may obtain a lien on the taxable property for the amount paid if the person is someone referred to in section 97.51(1) of the Property Assessment & Taxation Act. Assessed owners have the option of entering into an agreement to pay with the Town of Hay River. Such an agreement allows assessed owners to pay outstanding property tax arrears and collection costs in instalments. Arrangements to enter into an agreement to pay can be made through the Town of Hay River directly.

Brownlee LLP

Legal Counsel

Attention: Chris Franssen

Phone: (780) 497-4818

299 total views, 1 today